Financial Planning and Consumer Insights for 367211160, 625125411, 900900412, 645148246, 3295887340, 928404040

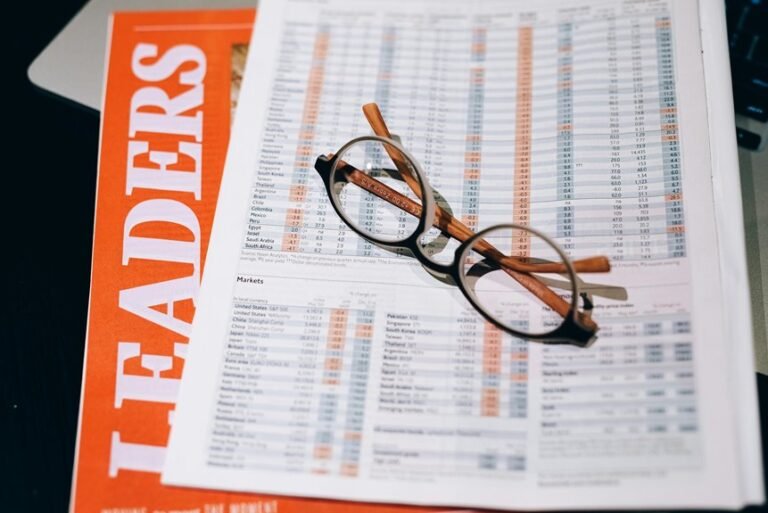

The financial landscape is evolving, shaped by identifiers such as 367211160, 625125411, 900900412, 645148246, 3295887340, and 928404040. Emerging consumer trends indicate a pronounced shift towards sustainability and ethical consumption. This necessitates a deeper understanding of current financial behaviors and preferences. Adapting to these insights could redefine investment strategies and savings approaches. The implications of these changes warrant further examination as they hold significant potential for future financial planning.

Analyzing Financial Identifier 367211160

The financial identifier 367211160 serves as a crucial reference point for analyzing consumer behavior and trends within financial markets.

It highlights the effectiveness of various savings strategies and investment options, revealing how individuals prioritize financial security and growth.

Exploring Consumer Behavior for 625125411

How do consumer behaviors manifest through financial identifier 625125411?

Analyzing this identifier reveals distinct consumer preferences and spending habits. Individuals associated with 625125411 exhibit a tendency towards sustainable products, reflecting a deeper awareness of ethical consumption.

Their spending is often characterized by prioritizing quality over quantity, showcasing a desire for meaningful purchases that align with personal values, ultimately influencing broader market trends.

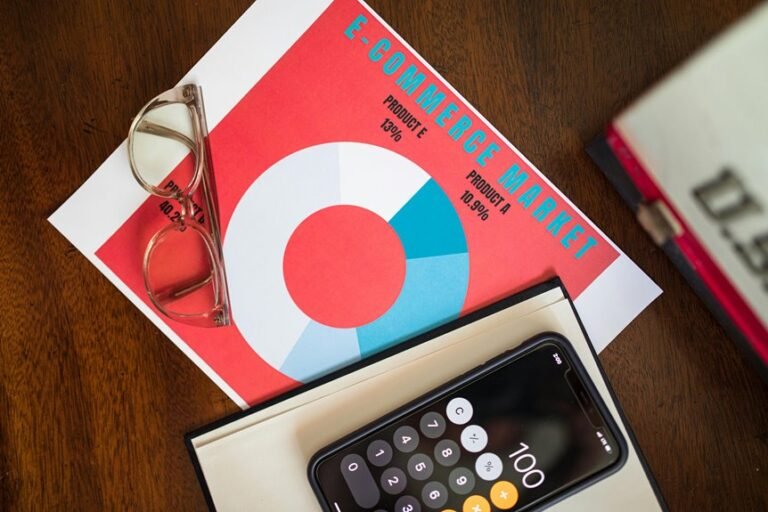

Trends Associated With 900900412 and 645148246

Consumer behaviors linked to financial identifiers 900900412 and 645148246 reveal significant trends that underscore evolving market dynamics.

Market analysis indicates a shift toward increased digital engagement and personalized financial solutions.

These consumer trends reflect a growing demand for transparency and flexibility, as individuals seek to optimize their financial planning strategies in a rapidly changing economic landscape, emphasizing the importance of adaptability and informed decision-making.

Insights From 3295887340 and 928404040

Emerging patterns from financial identifiers 3295887340 and 928404040 provide valuable insights into consumer preferences and behaviors within the current economic framework.

Analysis reveals a growing inclination toward diversified savings strategies, reflecting a desire for financial security.

Additionally, investment preferences indicate a shift towards sustainable assets, demonstrating an increasing awareness of ethical considerations in financial decision-making.

This evolution highlights a proactive approach to personal finance.

Conclusion

In conclusion, the evolving landscape of financial planning reflects a profound shift in consumer values, where sustainability and ethical considerations reign supreme. As individuals increasingly seek personalized solutions that align with their principles, the question arises: how will the financial industry adapt to meet these rising expectations? Ultimately, this transformation underscores the necessity for adaptability in financial strategies, as consumers prioritize not just security and growth, but also a harmonious balance between wealth and their ethical compass.